Leaving school is exciting. You’ve got your diploma or degree in hand, dreams in your heart, and maybe a job lined up. But then reality hits: student loan payments. For many, those monthly bills start six months after graduation. And sometimes, life gets in the way—job loss, medical bills, or just the high cost of living. If you’re staring at a payment notice and thinking, “Who Should You Contact if You Have Trouble Making Payments Once You Leave School? You don’t have to figure it out by yourself. There are people and organizations ready to help.

This guide will walk you through exactly who to contact when you’re struggling with student loan payments after leaving school. We’ll keep it simple, friendly, and easy to follow—no jargon, no stress. Whether you’re 22 or 52, just starting out or restarting after a break, this is for you.

First: Know Your Loan Type (It Matters!)

Before picking up the phone, take one minute to know what kind of loan you have. This decides who you call.

| Loan Type | Who Manages It? | Who to Contact First |

|---|---|---|

| Federal Student Loans (like Direct Loans, PLUS, Perkins) | U.S. Department of Education | Your loan servicer |

| Private Student Loans (from banks, credit unions, or online lenders) | The bank or company you borrowed from | The lender or servicer listed on your statement |

Step 1: Contact Your Loan Servicer (Your #1 Go-To Person)

Who Are They?

Your loan servicer is the company that collects your payments and manages your account. Think of them as your student loan “bank teller.”

What to Say When You Call

Be honest. You don’t need a perfect script. Try this:

“Hi, I’m calling because I’m having trouble making my student loan payment. I just graduated and [lost my job / had a baby / moved / got sick]. Can you tell me what options I have?”

They must help you explore options. It’s the law.

Your Options with Federal Loans (Help is Built In!)

Federal loans come with built-in safety nets. Here’s what your servicer can offer:

| Option | What It Does | Best For |

|---|---|---|

| Income-Driven Repayment (IDR) Plans | Payment = 5–20% of your income | Low or unstable income |

| Deferment | Pause payments (interest may grow) | Unemployment, cancer treatment, military service |

| Forbearance | Temporary pause or reduction | Short-term money problems |

| Graduated Repayment Plan | Low payments at first, increase later | New grads expecting raises |

| Extended Repayment Plan | Lower monthly payment over longer time | Want smaller bills, can pay longer |

Step 2: If You Have Private Student Loans

Private loans are trickier. They don’t have the same protections as federal loans. But many lenders still want to help—because they’d rather get some money than none.

Who to Contact

- Look at your latest statement — it says who to call.

- Or check your original loan paperwork.

- Common private servicers: Sallie Mae, Discover, SoFi, Citizens Bank, Wells Fargo.

What to Ask For

| Ask About | What It Means |

|---|---|

| Hardship Forbearance | Pause payments for 3–12 months |

| Interest-Only Payments | Pay just interest for a while |

| Reduced Payment Plan | Lower monthly amount temporarily |

| Loan Modification | Change terms (rare, but possible) |

Be Persistent: If the first person says “no,” ask to speak to a supervisor or hardship department.

Step 3: When to Contact a Student Loan Counselor (Free Help!)

If you’re confused, overwhelmed, or just want a human to explain your options, call a nonprofit credit counselor.

Top Free Counseling Services

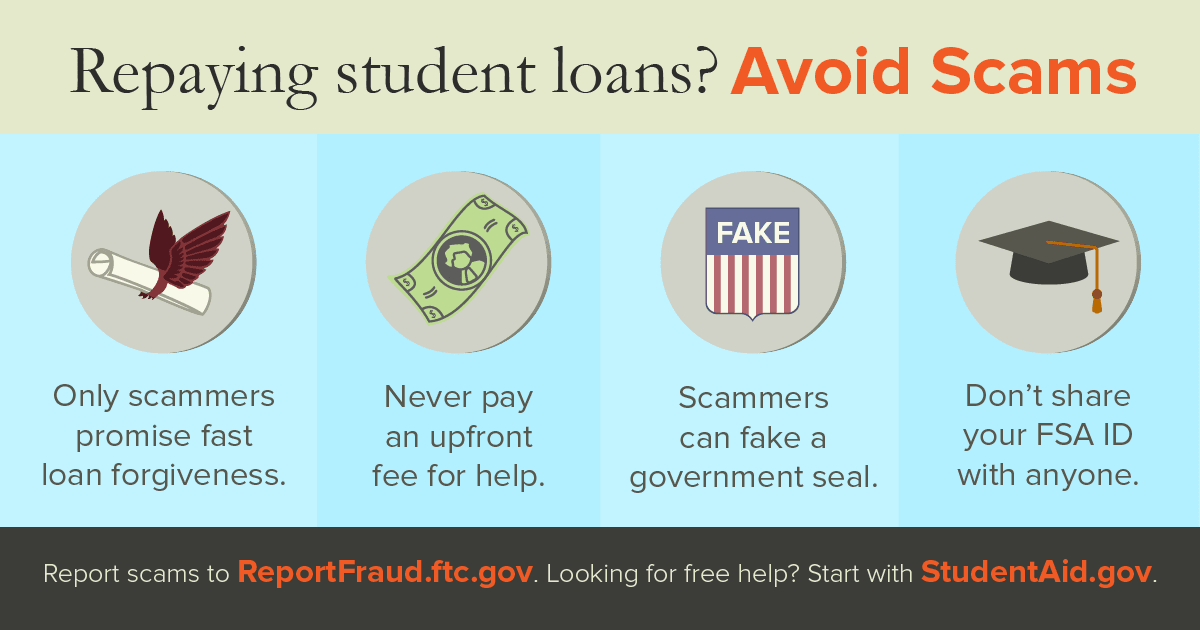

Warning: Avoid companies that charge $500+ to “fix” your loans. You can do this yourself or with free help.

Step 4: If You’re in Default (Already Behind 270+ Days)

Default = big trouble. Wages garnished, tax refunds taken, credit ruined. But you can get out.

Who to Contact

- Your loan servicer — ask about loan rehabilitation.

- Call the Default Resolution Group at 1-800-621-3115.

- Or work with a nonprofit counselor (see above).

Rehabilitation: Make 9 on-time payments (often income-based). Default is erased from credit report.

Quick Action Checklist (Print This!)

| Done? | Action |

|---|---|

| ☐ | Log into → Find your servicer |

| ☐ | Call your servicer → Say: “I need help with payments” |

| ☐ | Ask about IDR, deferment, or forbearance |

| ☐ | If private loan → Ask for hardship options |

| ☐ | If confused → Call NFCC at 1-800-388-2227 |

| ☐ | If in default → Call 1-800-621-3115 |

Real Stories: You’re Not Alone

Sarah, 24, Barista “I graduated with $28,000 in federal loans. My coffee shop cut my hours. I called MOHELA and got on SAVE Plan—my payment dropped from $300 to $45/month. I cried happy tears.”

Mike, 38, Single Dad “Private loans with Sallie Mae were killing me. I called, explained I had custody of my kids. They gave me 6 months of interest-only payments. It saved me.”

Aisha, 29, Unemployed “I ignored my loans for a year. Went into default. A counselor at NFCC helped me rehabilitate in 9 months. My credit is healing.”

Common Mistakes to Avoid

| Mistake | Why It Hurts | What to Do Instead |

|---|---|---|

| Ignoring letters/calls | Leads to default | Open mail, answer calls |

| Paying shady “relief” companies | Scams take your money | Use free .gov or nonprofit help |

| Assuming you “can’t afford help” | You qualify for $0 payments | Apply for IDR anyway |

Frequently Asked Questions (FAQs)

1. What if I don’t know who my loan servicer is?

Log into or call 1-800-433-3243.

2. Can I pause private loans too?

Yes—many offer hardship forbearance. Just ask.

3. Will asking for help hurt my credit?

No. Applying for IDR, deferment, or forbearance does not hurt your credit.

4. What if I’m on disability?

You may qualify for Total and Permanent Disability Discharge. Call your servicer.

5. Can my parents help if they co-signed?

Yes, but they’ll need to call too. Private lenders often require co-signer involvement.

Final Words: You’ve Got This

Struggling with student loans after school doesn’t mean you failed. It means life happened—and that’s okay. The system is built to help you, not punish you.

Pick up the phone today. One call to your servicer or a free counselor can change everything.

You worked hard for your education. Now let the system work for you.